Family office

Precision

Personalized

Wealth solutions

MONEY

GETS

COMPLEX

The uber-rich use family office, a full-service wealth management setup that serves just that one family. Because, as they say, money gets complex once you have made it.

We rejigged the family office model through workflow automation to serve not just the wealthy but also the aspirationally wealthy.

And complexity is real. Investments, taxes, retirement planning, employee benefits, insurance, estate planning, cash flow planning, legacy planning, philanthropy – all these areas intersect.

We un-complex it all for you.

The

Sacred

Fig

The Sacred Fig in Anuradhapura, Sri Lanka, is the oldest living human planted tree in the world, having survived some 2,000 years and still bearing fruits.

We think about wealth the same way. We design an endowment-style version of your money through good process and good investing. The seeds you sow today should not just provide you a better future tomorrow but by making it into a wholesome family affair, we want to avoid that oft-repeated shirtsleeves-to-shirtsleeves in three generations cycle.

Because lasting wealth is not just about money. It is about the values you impart around money. It is about the coaching and the recurring interventions needed around money that impacts every decision you make as a family. We’ll make your version of The Sacred Fig last long.

HOW

we

PLAN

The wonders of free market capitalism are all around us. We are in the business of backing the businesses that lets capitalism do its magic.

We believe in long-term ownership of investments. We use these investments to build a pension plan around your life goals.

And we manage that plan like how a pension plan would. Your plan evolves as you pass through the many life stages but big sudden changes based upon short-term market events is what we won’t do.

We invest as if the Efficient Markets theory holds. Markets though are seldom efficient – in the short run. But over decades long timeframes that we care about, the price and the value of an investment will converge. We invest with that in mind.

Talk about value, we must be able to derive a value for any investment we use in your plan. Assets must produce cash flows or have a prospect of producing cash flows. Anything that does not conform to that, we deem that as speculation. We won’t speculate with your money.

Markets will suck from time to time and sometimes they’ll suck for years. And since you’ll be an active participant in the markets, your portfolio will suck along. That is the nature of the game.

But you must stick around and continue to feed your plan because that eventual recovery is what will shorten your time to financial independence.

Process is what we control. Outcomes are seldom in our control. Getting the process right is where we spend most of our time. We then let the markets do their work. But your understanding of the process is critical for the long-term survival of your plan.

With time, the plan we build together becomes a living, breathing document that you get frequent updates on. It’ll become a blueprint of your money life.

NO

CompartmentalizATION

Financial Planning

Every account talks to all other accounts you own as a family. We weave all that into an ever-evolving, easy to understand, one-page plan. No gobbledygook, no obfuscation, no confusion. All you need to know about your money in a mere five minutes.

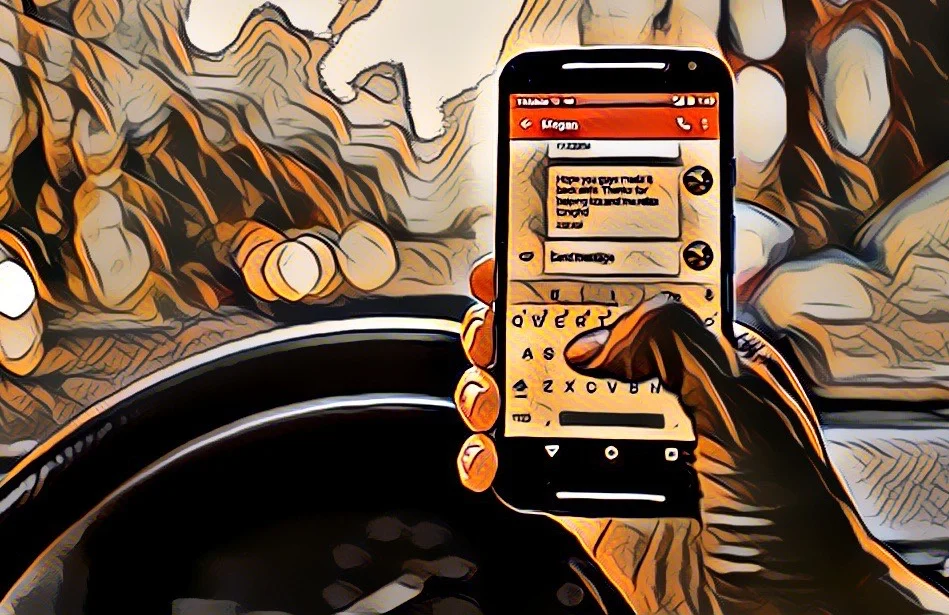

Risk Management

The ups and downs in your portfolio’s value is not true risk. Your true risk is your teenage daughter getting into a car accident. Your true risk is about life & limbs. How will your family cope if something were to happen to you? We make sure you own good insurance to protect against all odds.

Tax & Legacy Planning

Tax planning does not happen on April 15th. It happens throughout the year. And it flows from one year to the next. The goal is to reduce your lifetime taxes. We don’t make the rules but good tax planning also trickles into legacy planning and that is where your heirs (not you) make big tax bank.

Data

SCIENCE

YOUR

MONEY

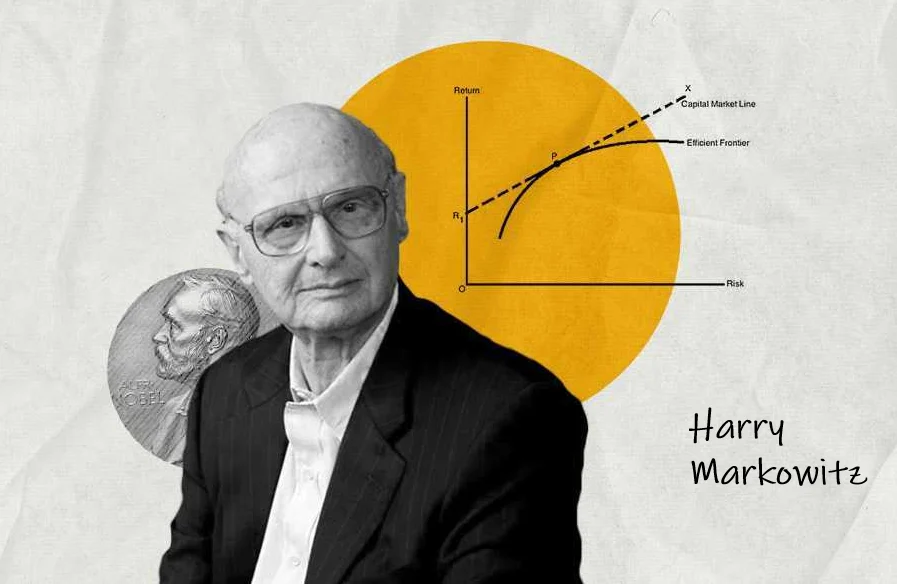

We take risks that we can statistically model. Modern Portfolio Theory, a risk-return optimization framework is the backdrop we use to manage your savings. There’ll be tweaks along the way but never any big deviations.

And we want to make sure that you own the right investments in the right accounts while minimizing overlaps between investments across accounts. We couldn’t find a tool that did what we needed so we built our own – a self-updating portfolio analytics platform that pulls data from relevant sources and flags when changes are needed.

We then Monte-Carlo simulate the heck out of your plan to make sure you never run out of money before you run out of time.

And all this is automated including the plan generation process by borrowing some of the best tools from the wide open field of data science.