How long will you live? Average life expectancy these days for a typical American is about 80 years.

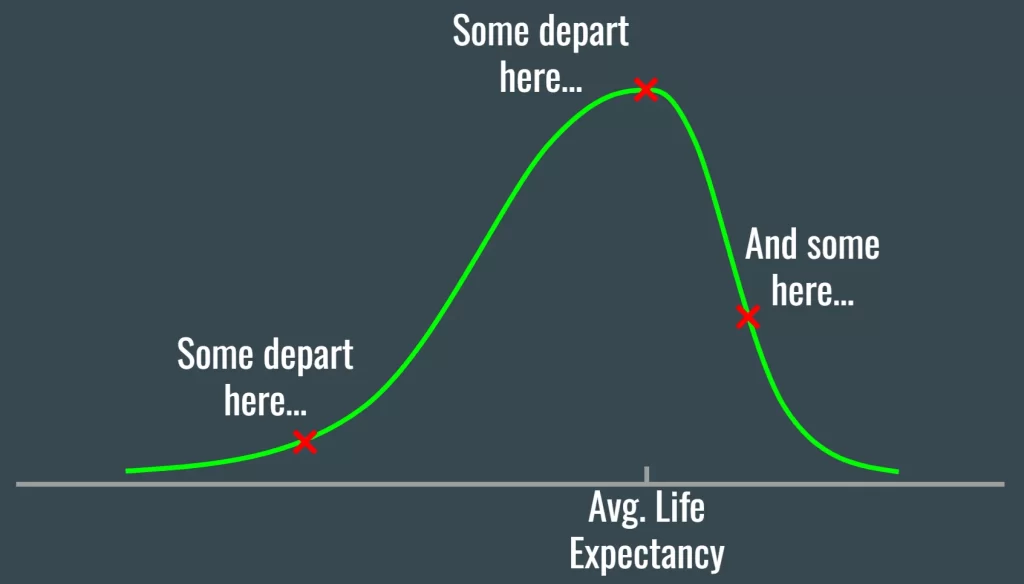

And that life expectancy is somewhat distributed like this…

It is skewed left because some unlucky few will lie on the extreme left of the distribution, a major chunk will live close to the average age and some to the right of that average. That is today and the entire curve will shift right with time as life expectancies continue to rise.

So, if you were planning your own retirement, what life expectancy would you assume? Because that is the holy grail. You know when you are going to depart and the rest of the math is easy.

But we do not know that and that is why retirement planning gets tricky. That was not always the case though.

Employers of the past offered something called a defined benefit pension plan. A pension plan fundamentally is a risk-reduction setup, designed to guarantee that no one who participates in that plan goes without income during retirement.

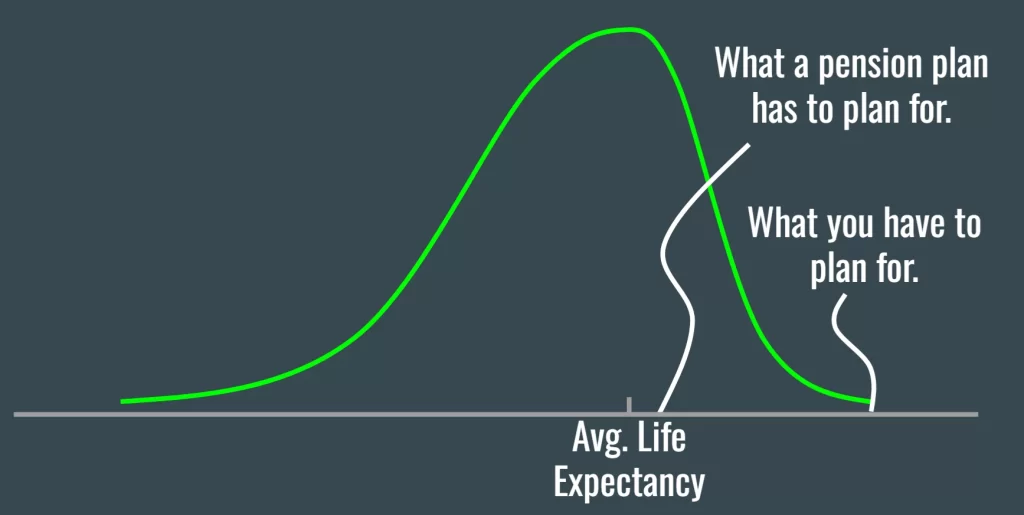

And because life expectancy risk gets pooled in a pension plan means that we did not have to save as much. Folks dying early paid for those who lived longer. All that was required of the plan to remain solvent was to have enough assets to cover life expectancies up to just to the right of the average to allow for some buffer.

And not just that, the employers we worked for hired the best planners and investment managers money could buy to design a plan that lasts. You didn’t have to lift a finger. You needn’t need to know what the markets or the economy were doing at any given time. You just did your life’s work and the rest fell in place.

But pension plans have gone the way of the do-do bird. The businesses who offered these plans do not want anything to do with them. And why should they. Why would a company in the business of making widgets take on this added liability of retirement planning for their employees?

And who sticks around long enough to avail themselves of a pension anyway?

So, for all these reasons, you now must build your own pension plan. Not only do you have to save and invest right during your accumulation years, but you also must take the money out rightly from the many accounts you’ll own during your distribution years.

But how long do you need to make your money last? Unlike a traditional pension plan, you now need to account for the fact that you could be a demographic outlier. That is, you might live way beyond what life expectancy tables show.

So, you have to design your own pension plan and because there is no pooling of life expectancy risk, you have to save more, much, much more than what you would have had to if you had access to traditional pensions.

But all is not lost in this game because unlike traditional pensions, your one-participant plan does not need to generate income till you retire. Your portfolio, hence, can afford more risk than what a traditional pension plan can. That then helps reduce the amount you need to save by some factor.

Plus, if you do happen to save more than you will ever be able to spend, the leftover assets are there to bequeath as you please.

That is not true with traditional pensions because you depart from this planet and your pension departs with you. There are no assets to bequeath.

So that is all good but then many of us still invest by the seat of our pants. Markets sell-off and we panic. Markets ride high and we get euphoric. Most do not invest with a pension-like discipline and structure. For this and many other reasons, I wish we could somehow go back to the retirement savings system of the past.

Because if you read what I read on how ill-prepared we are as a country on the retirement savings front, you’d be depressed. Because it will be a burden and the ill-prepared are going to bear the brunt of it.

Thank you for your time.

Cover image credit – Pedro Ribeiro Simões, Flickr